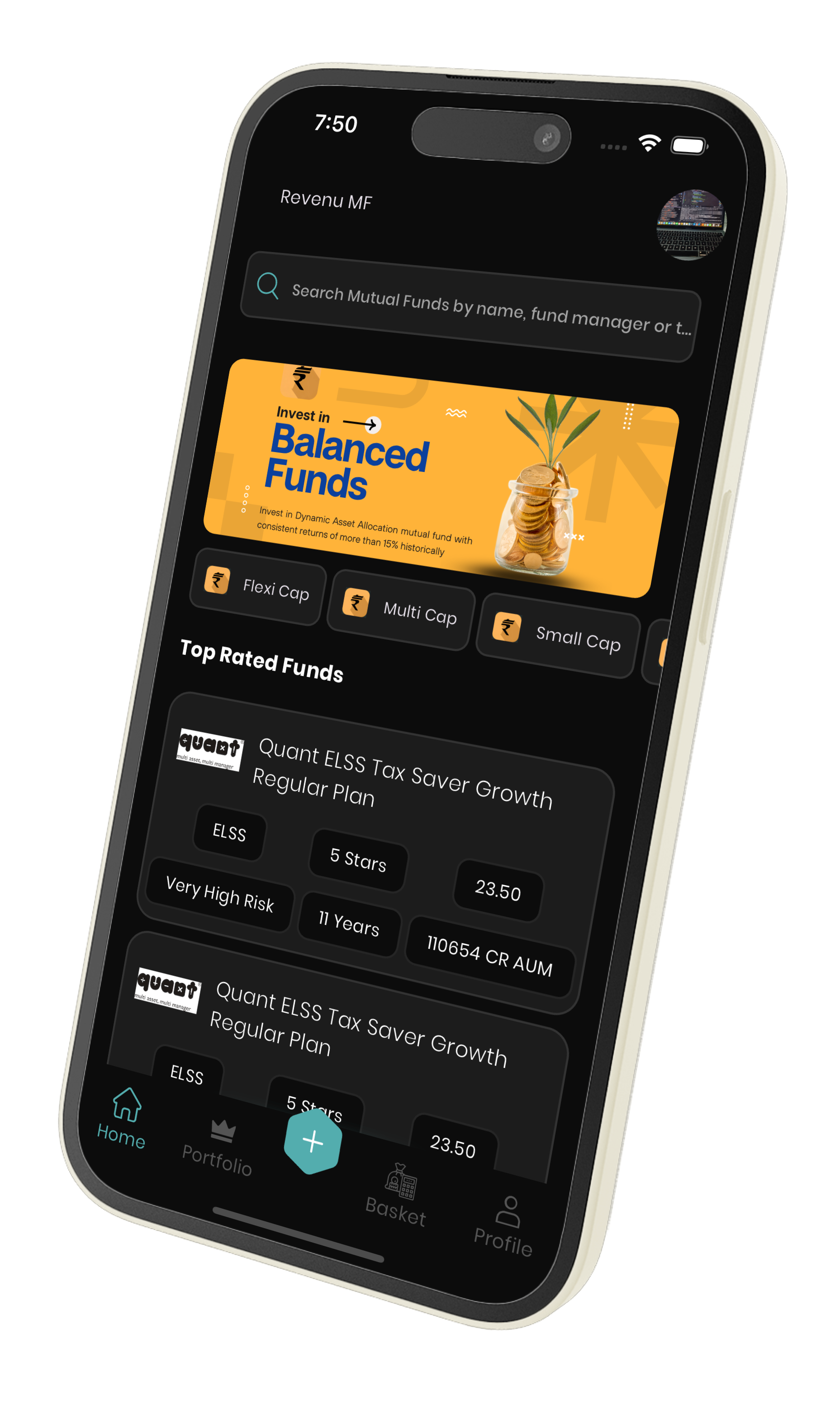

Mutual Funds

To Invest in

Active

Clients

Outperforming

Investment Baskets

* CAGR

On Aggressive Basket

Why invest with Revenu?

By choosing to invest with us, you're partnering with a trusted financial firm that is committed to helping you achieve your financial goals.Equity Vs. Debt

A common rule of thumb is to subtract your age from 100 to determine the percentage of your portfolio that should be allocated to equity funds. For example, a 30-year-old investor might consider allocating 70% to equity funds and 30% to debt funds.Equity Funds

1

Capital Appreciation

Very high since equity markets invest in top companies with higher returns potential

5/5

2

Capital Protection

Very low as Equity market contains capital risk

3/5

3

Investment Horizon

Typically Long term

4

Investment Objective

Generate Wealth

Invest towards a goal

Debt Funds

1

Capital Appreciation

Moderate as these bonds invest in money markets or bonds which are able to beat FD returns

3/5

2

Capital Protection

Very High since the funds are not linked to market they tend to give consitent returns but they do carry default risk

4.5/5

3

Investment Horizon

Typically Short Term

4

Investment Objective

Consistent returns without high risk

Invest Smarter, Grow Faster.

Diverse Range of Mutual Funds

A Comprehensive Guide to Mutual Fund Investing: Explore the Diverse Range of Options and Find the Perfect Fit for Your Financial Goals.%

Large Cap

%

Mid Cap

%

Small Cap

%

ELSS

%

Flexi Cap

%

Balanced

%

Debt

Checkout category average returns across top mutual fund categories

Invest in 40+ AMCs

Find the perfect fund for your goals from our extensive selection.

Benefit from the expertise of India's leading asset management companies.

Client's Testimonials

I believe that working hard and trying to learn every day will make meimprove in satisfying my customers.

Common Questions

A mutual fund pools money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities.

We offer four distinct mutual fund baskets: Aggressive Basket, Moderate Risk Basket, Conservative Basket, and Tax Saving Basket.

Active rebalancing means we continuously monitor and adjust your portfolio's asset allocation to ensure it remains aligned with your investment goals.

Each basket is designed for different risk appetites and goals. You can use our investment questionnaire to find the right one for your needs.

The minimum investment amount varies by basket and fund. You can see specific requirements once you select a basket.

Yes, you can switch between baskets, but tax implications and exit load charges may apply.

The Tax Saving Basket primarily invests in ELSS funds, which offer tax deductions under Section 80C.

Mutual funds generate returns through capital appreciation of the securities in the portfolio and dividends or interest earned from investments.

ELSS (Equity Linked Savings Scheme) funds are equity mutual funds that offer tax deductions under Section 80C, whereas other mutual funds may not have tax benefits.

Mutual funds carry market risk, meaning their value can fluctuate based on the performance of the underlying securities. Higher-risk funds like small-cap or sector-specific funds may have more volatility.